Total Debt

Outstanding

|

Interest Rate

|

Monthly Payments

|

|

John

|

$100k

|

3%

|

$422

|

Sally

|

$50k

|

10%

|

$439

|

Here is another example. The numbers are rough ballpark estimates, but I think they show the issue pretty well:

Total Debt

Outstanding |

Interest Rate

(% of GDP) |

Annual Interest Payments

(% of GDP) |

|

Obama

(end of first term) |

100% of GDP

|

< 3%

|

> 3%

|

Reagan

(end of second term) |

50% of GDP

|

< 10%

|

< 2%

|

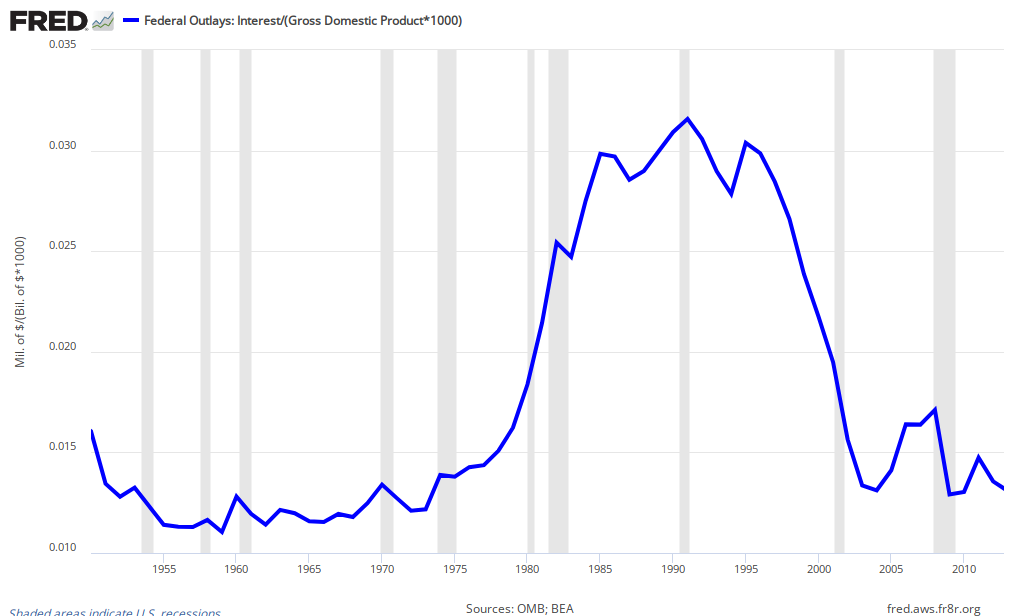

This time I am only looking at interest payments rather than amortizing the principle, but the same principle applies as in the first table. It isn't clear if the real debt burden is higher in 2012 under Obama or in 1988 under Reagan. Of course, these are not real interest rates and so the real expected future interest burden was much less in the high-inflation Reagan years, but the current burden of the debt is the current amount of income that must be sacrificed to pay for debt service which is shown in the graph below.

Dean Baker says that government interest payments are a better measure of our government debt burden than the actual amount of debt. Note that although the interest burden is expected to rise rapidly, in 2012 we are still well below where Reagan and Bush ever got and that did not pose a big problem for the economy.

And what would happen if interest rates rise? Baker has a good answer for that too:

Am I pulling a fast one here by switching from debt to interest payments? Not at all. Suppose we issue $4 trillion in 30-year bonds in 2012 at 2.75 percent interest (roughly the going yield). Suppose the economy recovers, as CBO predicts, and the interest rate is up around 6.0 percent in 4-5 years. The federal government would be able to buy back the $4 trillion in bonds it had issued for roughly $2 trillion, immediately eliminating $2 trillion of its debt. This will make those who fixate on the debt hysterically happy, but will not affect the government's finances in the least. It will still face the same interest obligation.I am not as sanguine as Baker about rising interest rates, but he is certainly correct that they have no impact in the short run, ceteris paribus. And one of the things that would raise interest rates is a growing economy which would help us pay off the debt too.

More than half are elderly

More than half are elderly