It's often wise to pay more attention to marginal tax rates than to average tax rates. If you can make your first $100 tax free but the 101st dollar is taxed at a marginal rate of 99% you'll probably decide to earn $100 at most.

But what is marginal? When it comes to career choices or the state you'll live in or whether to have an extra child the marginal decision is very big, and a rational person will base that decision mostly on the average long run costs and benefits. In cases like this, the official marginal tax rate won't matter nearly as much as the long run average tax rate.This isn't just a theory: It appears to be true for that most economistic of organizations, the multinational corporation. When multinationals are deciding which country to invest in, they don't pay that much attention to marginal tax rates. According to Glenn Hubbard,...investment location decisions are more closely related to average rather than marginal tax rates.When making the go/no-go decision, corporations care more about their long run tax bill. That's because the marginal decision is the go/no-go decision....when people are deciding whether to become medical doctors or mere professors, lawyers or struggling novelists, entrepreneurs or Xbox champions, these go/no-go decisions will be shaped by the average tax rate that the rich will have to pay for decades to come....That's just a case of applying Hubbard's idea: the marginal tax rate didn't matter when you chose your career, but the average tax rate--after deductions--mattered enormously.In the long run we should worry more about average tax rates.

Thursday, December 20, 2012

Average Tax Rates Matter Most For Some Decisions

What is 'marginal' is what is avoidable when you make a decision. If you decide to work one more hour this year, then the marginal tax rate is what is avoidable. If you decide what career for the next year, your future average tax rate is what is avoidable. Garett Jones:

Tuesday, November 27, 2012

Interest group politics and pot

It is always interesting to see how interest groups are lobbying. It turns out that medical marijuana vendors are lobbying against pot legalization because they prefer to have a special license to sell the stuff and full legalization would result in more competition and lower prices for medical marijuana. The beer lobby is also worried that marijuana will be a substitute and not a compliment for beer. There is academic research that has demonstrated this.

And casino operators have joined the anti-gambling movement to help fund the political battle against a new casino in Maryland because it would increase competition and lower prices.

Hat tip Yglesias.

And casino operators have joined the anti-gambling movement to help fund the political battle against a new casino in Maryland because it would increase competition and lower prices.

Hat tip Yglesias.

Sunday, November 25, 2012

Optimal Taxation of Externalities Hurt the Poor

Charles Wheelan, Naked Economics, 2010, pp 51-52.

...both a gasoline tax and an income tax generate revenue. Yet they create profoundly different incentives. The income tax will discourage some people from working, which is a bad thing. The gasoline tax will discourage some people from driving, which can be a very good thing. Indeed, "green taxes" collect revenue by taxing activities that are detrimental to the environment and "sin taxes" do the same thing for the likes of cigarettes, alcohol, and gambling.In general, economists tend to favor ...a gasoline tax ...[which] also provides an incentive to conserve fuel. Those who drive more pay more. So now we're raising a great deal of revenue with a tiny tax and doing a little something for the environment, too. Many economists would go yet one step further: We should tax the use of all kinds of carbon-based fuels, such as coal, oil, and gasoline. Such a tax would raise revenue from a broad base while creating an incentive to conserve non-renewable resources and curtailing the CO2 emissions that cause global warming.Sadly, this thought process does not lead us to the optimal tax. We have merely swapped one problem for another. A tax on red sports cars would be paid only by the rich. A carbon tax would be paid by rich and poor alike, but it would probably cost the poor a larger fraction of their income. Taxes that fall more heavily on the poor than the rich, so-called regressive taxes, often offend our sense of justice. (Progressive taxes, such as the income tax, fall more heavily on the rich than the poor.)

Economies of Scale and Illegal Drugs

Real prices for illegal drugs have dropped dramatically since the 1970s due to the same technological forces that have boosted globalization in other industries. For example, the price of cocaine dropped in half in Europe between 1990 and the early 2000s. But compared with legal pharmaceuticals and agriculture, illegal drug businesses are still incredibly fragmented and inefficient.

Some rare light was shed on the [drug] business by a [British] Home Office study in 2007, in which 222 drug-dealers were interviewed in prison by analysts from Matrix Knowledge Group, a consultancy, and the London School of Economics. ...Most drug businesses are forced to stay small and simple to evade the police. Only one dealer claimed to be part of an organisation of more than 100 people, and a fifth were classified by researchers as sole traders. Fear of being uncovered also hampers recruitment: most dealers stuck to family and friends, and people from the same ethnic group, when hiring associates. Just like other businessmen, they carried out criminal-record background checks on potential employees—except that, in this case, a record was a good thing.Colorado, Washington state, the Netherlands, and a few other places have legalized the possession and use of marijuana, but these experiments only legalized possession and the industrial-scale production and dealing is still illegal. This is still nothing like what full legalization would look like. If agribusiness giants like Monsanto began breeding new strains for greater productivity and if tobacco giants like Phillip Morris developed processing and retail giants like Walmart did the distribution, then marijuana would be so cheap, it would be given away for free at some places because it would be cheaper than a packet of free sugar or ketchup at McDonalds.

Kevin Marsh, an economist at Matrix Knowledge, argues that most players in the drug business have a poor knowledge of the market. “Shopping around for new wholesale suppliers is risky, so many retailers stick to the same one and pay over the odds,” he says.

marijuana is a nonperishable bulk commodity like wheat or lentils. For such commodities, the final price to the end user is dominated by the cost of production.The tomato price would skyrocket because the new tomato production methods would be so much less efficient compared with modern industrial methods for producing and distributing tomatos.

Try to imagine a world in which you’re allowed to have some tomatoes in your house, you’re allowed to cook tomatoes, you’re not punished for having tomatoes in your possession if the cops stop you, and you’re even allowed to buy tomatoes at specialty tomato stores—but where it’s illegal to actually grow tomatoes. The price of tomatoes is going to escalate enormously. The problem isn’t [just] that the tomatoes will suddenly disappear from supermarket shelves (though they will) but that all the farms will have to shut down. Which isn’t to say that nobody will grow tomatoes. People like tomatoes. So tomatoes will be smuggled in from Mexico. Tomatoes will be grown in backyards. People will use lights and hydroponic rigs to grow tomatoes indoors.

America’s farmlands are some of the most productive in the world, thanks in no small part to technology and the existence of scale sufficient to leverage that technology. Even what Americans think of as a small family farm is quite large compared with an illicit marijuana operation. There are no amber waves of cannabis anywhere in the world today, but under a true legalization regime there would be. And this makes all the difference.At those prices, pot prices would not only blow alcohol out of the water, a joint would be cheaper to serve than water itself. A 'free' paper cup of water costs McDonalds more than a few cents. A pound of pot is enough to make 800 joints and it could be produced for as low as 20 cents.

How cheaply could pot be grown with advanced farming techniques? One potential data point is Canada’s industrial hemp industry, where production costs are about $500 per acre. If the kind of [low-grade] commercial weed that accounts for about 80 percent of the U.S. market could be grown that cheaply, it implies costs of about 20 cents per pound... [Better quality] marijuana is grown from more expensive transplanted clones rather than from seeds. Even so, the authors note that “production costs for crops that need to be transplanted, such as cherry tomatoes and asparagus, are generally in the range of $5,000-$20,000 per acre.” That implies costs of less than $20 per pound for [top quality] and less than $5 a pound for mid-grade stuff. Another way of looking at it, suggested by California NORML Director Dale Gieringer, is that we should expect legal pot to cost about the same amount as “other legal herbs such as tea or tobacco,” something perhaps “100 times lower than the current prevailing price of $300 per ounce—or a few cents per joint.”

This would make pot far and away the cheapest intoxicant on the market, absolutely blowing beer and liquor out of the water. Joints would be about as cheap as things that are often treated as free. Splenda packets, for example, cost 2 or 3 cents each when purchased in bulk.

Thursday, November 22, 2012

Irrational Fears Kill Thousands of Americans Annually

Charles Kenny says, "Airport Security Is Killing Us":

Of the 150,000 murders in the U.S. between 9/11 and the end of 2010, Islamic extremism accounted for fewer than three dozen. Since 2000, the chance that a resident of the U.S. would die in a terrorist attack was one in 3.5 million, according to John Mueller and Mark Stewart of Ohio State and the University of Newcastle, respectively. In fact, extremist Islamic terrorism resulted in just 200 to 400 deaths worldwide outside the war zones of Afghanistan and Iraq—the same number, Mueller noted in a 2011 report (PDF), as die in bathtubs in the U.S. alone each year...

According to one estimate of direct and indirect costs borne by the U.S. as a result of 9/11, the New York Times suggested the attacks themselves caused $55 billion in “toll and physical damage,” while the economic impact was $123 billion. But costs related to increased homeland security and counterterrorism spending, as well as the wars in Iraq and Afghanistan, totaled $3,105 billion. Mueller and Stewart estimate that government spending on homeland security over the 2002-11 period accounted for around $580 billion of that total.

The researchers quote Rand Corp. President James Thomson, who noted most of that expenditure was implemented “with little or no evaluation.” In 2010, the National Academy of Science reported the lack of “any Department of Homeland Security risk analysis capabilities and methods that are yet adequate for supporting [department] decision making.”...

There is lethal collateral damage associated with all this spending on airline security—namely, the inconvenience of air travel is pushing more people onto the roads.... To make flying as dangerous as using a car, a four-plane disaster on the scale of 9/11 would have to occur every month, according to analysis published in the American Scientist. Researchers at Cornell University suggest that people switching from air to road transportation in the aftermath of the 9/11 attacks led to an increase of 242 driving fatalities per month—which means that a lot more people died on the roads as an indirect result of 9/11 than died from being on the planes that terrible day. They ...suggest that enhanced domestic baggage screening alone reduced passenger volume by about 5 percent in the five years after 9/11, and the substitution of driving for flying by those seeking to avoid security hassles over that period resulted in more than 100 road fatalities.

This is part of the logic for why infant car seats are not required on airlines. If parents were required to lug heavy carseats onto airlines and pay for an extra seat, more parents would drive instead of flying and that would kill more infants than the carseats on airlines would save. Yglesias asks why terrorists don't try to blow up any softer US targets:

If commercial airplanes were no more secure than your average city bus, planes would be blown up as frequently as city buses—which is to say never. I've heard some people postulate that terrorists have a special affection for blowing up planes, but I'm not sure that's right. In the not-too-distant past, Israel had a substantial terrorists-blowing-up-buses problem and had to take countervailing security measures. But unlike Israel, we're not doing anything to secure our buses. It's at least possible that nobody blows up American buses because nobody is trying to blow anything up.

Tuesday, October 23, 2012

Baumol's Cost Disease

Moneybox:

The most important disagreement between Romney and Obama that keeps not getting covered properly is the dispute over Medicaid. The Obama administration wants to spend a lot of new money to provide Medicaid coverage to a much larger set of the working poor. Romney, by contrast, wants to spend drastically less money on the program... Notionally, Romney's idea is that by not merely implementing huge cuts in funding levels but also offering states more flexibility about the rules that he'll be able to usher in a bright new era of innovation.Not only will labor-intensive human care get relatively expensive as productivity increases elsewhere, but Medicaid administrators will be increasingly tempted to shift resources away from labor-intensive services and towards things like cheap new drugs that do see costs declining as technology advances. A similar dynamic is happening with military spending:

In the real world, what happens if you're given less money to cover people with and more flexbility about what to do with it what you're going to do is simply cover fewer people. In particular, care for the elderly and disabled are likely to get hammered over the long-term thanks to productivity issues. Medical technology does advance and that sometimes leads to great new things—pills that treat illnessness, machines that help us test for disease—but the foundation of long-term care for the elderly and the disabled is human attention. People who need help caring for themselves on a day-to-day basis need help from other human beings. If you take the main public program for financing that kind of care and insist on its budget shrinking as a share of GDP, then the people who need help are out of luck. As economy-wide productivity rises, it'll get harder and harder to "afford" programs that provide labor intensive care even in the real world society will be richer than ever.

Many... are upset that military spending as a share of U.S. GDP is far lower today than it was during the Cold War era. A conventional... reply is to note that the objective threat environment is very different. But perhaps a better way of looking at this issue is through the lens of productivity. If you have an industry where productivity advances slower than average then spending as a share of GDP needs to rise to keep quality constant. ...In the military sector you see some interesting dynamics. Thanks to technology, we're way better at a task like "make this guy's house explode" than we used to be. First airplanes and then precision munitions and now unnmanned aerial vehicles have made this vastly cheaper and easier than it was in 1912.

But for other kinds of tasks, technology progress hasn't helped much. In particular "boots on the ground" occupation-and-administration of foreign territory suffers from a similar [labor-intensive] dynamic as kindergarden. ...If we want to maintain a roughly constant level of boots on the ground operations then spending as a share of the economy has to steadily rise, while if we're content to explode things from afar it can steadily fall.Which is perhaps a roundabout way of saying that on both the military and civilian sides of the government, I think there's too much talk in D.C. about "budget math" and not enough talk about what specifically we're trying to accomplish and why.

Tuesday, October 9, 2012

Intellectual Property

Pharmaceutical companies spend $19 for promotion and marketing for every dollar they spend on basic research. Even if you include all spending on drug development, they still spend more than twice as much on marketing as on research and development. The tech industry is similar. Charles Duhigg and Steve Lohr report that:

Zach Carter shows that patent reform is needed, but that it is unlikely.

Last year, for the first time, spending by Apple and Google on patent lawsuits and unusually big-dollar patent purchases exceeded spending on research and development of new products, according to public filings.Even if patents increase innovation, it is costly and in some cases, innovation can be bad for society. For example, Apple computer won a billion dollar verdict against Samsung. It is hard to imagine that Samsung really did a billion dollars of damage to Apple, the world's most profitable company, and Samsung has clearly benefited consumers which is the whole point of patents in the first place. Governments should be encouraging competition with Apple rather than stifling it.

What troubles me [with the Apple-Samsung verdict is upholding the idea that] Apple should have a legal monopoly on the pinch-to-zoom feature which I think is a great example of how the modern-day patent system has gone awry.Software has particularly bad intellectual property laws

Think about cars and you'll see that, of course, lots of different companies make cars. But they all have some very similar user interface elements. In particular, there's a steering wheel that you turn left and right to shift the wheels and there's a gas pedal and brakes that you hit with your right foot. Imagine if the way the automobile industry worked was that each car maker had to devise a unique user interface. So maybe GM cars would have a steering wheel, but Toyotas would have a joystick, and Honda you would steer with your feet and use your hands to control the gas and brakes.In some sense there'd be "more innovation" in this world since there'd be this kind of arbitrary proliferation of user interfaces. But in a more important sense there'd be less competition, since there are only so many viable ways for a person to interact with a car and a lot of those ways suck. You'd have few new entrants, and those entrants would be hobbled from the get-go. Meanwhile, UI proliferation would make it much harder for people to switch car brands or launch car rental companies since with each brand reinventing the steering wheel you'd constantly need to be learning to drive again.

Large firms like Apple, Microsoft, Motorola, and Samsung are suing one another over mobile phone patents. And as a recent episode of This American Life documented, there are entire office buildings full of "patent trolls" that produce no useful products but sue other companies that do. What has gone largely overlooked in the coverage of the “patent wars,” however, has been the disproportionate burden placed on small firms—which has enormous consequences for the movement toward DIY innovation.

Software is unusual because it is effectively eligible for both copyright and patent protection. Patents traditionally protect physical machines or processes, like the light bulb, the vulcanization of rubber, or the transistor. Copyrights protect written and audiovisual works, like novels, music, or movies. Computer programs straddle this boundary. They are written works, but when executed by computers, they affect the real world. Since the 1990s, courts have allowed software creators to seek both copyright and patent protections.

While copyright law has served the software industry well, the same is not true of patents. Copyright protection is granted automatically when a work is created. In contrast, obtaining a patent is an elaborate, expensive process. Copyright infringement occurs only when someone deliberately copies someone else's work. But a programmer can infringe someone else's patent by accident, simply by creating a product with similar features.

The patent system doesn't even offer software developers an efficient way of figuring out which patents they are in danger of infringing upon. It’s a matter of arithmetic: There are hundreds of thousands of active software patents, and a typical software product contains thousands of lines of code. Given that a handful of lines of code can lead to patent infringement, the amount of legal research required to compare every line of a computer program against every active software patent is astronomical.

Little wonder, then, that most software firms don't even try to avoid infringement. Defending against patent litigation is simply seen as a cost of doing business in the software industry. Startups hope that by the time the inevitable lawsuits arrive, they will have grown large enough to hire good lawyers to defend themselves. But as the number of software patents—and with it, the volume of litigation—has soared, smaller companies have become targets.

These startup firms face legal threats from two directions: patent trolls and large incumbents like Microsoft and IBM that demand small firms pay them licensing fees.

The contrast between Microsoft and Google helps to illustrate the problem. The U.S. Patent Office has issued Microsoft more than 19,000 patents since 1998, the year Google was founded. In contrast, Google has been issued fewer than 1,100. While Microsoft is undoubtedly an innovative company, it's hard to argue that it has been almost 20 times as innovative as Google in the last 14 years. Rather, Microsoft's larger portfolio reflects the fact that a decade ago, Microsoft was a mature company with plenty of cash to spend on patent lawyers, while Google was still a small startup focused on hiring engineers.

Most of Microsoft's patents cover relatively pedestrian features of software products. In a pending lawsuit against Barnes & Noble, for example, Microsoft asserts that the Nook infringes patents on the concept of selecting text by dragging "graphical selection handles" and the idea of displaying a website sans background image while waiting for the background image to load. Individually, these patents are unremarkable. But when consolidated in the hands of one firm, they form a dense "patent thicket." Microsoft's vast portfolio—reportedly numbering about 60,000 when acquisitions are taken into account—allows the Redmond, Wash., software giant to sue almost any software firm for patent infringement.

And that makes Microsoft a de facto gatekeeper to the software industry. This isn't a problem for other large incumbents, such as Apple and IBM, which have thousands of their own patents and use them to negotiate broad cross-licensing agreements. But small firms haven't had the time—or the millions of dollars—to acquire large portfolios.

And that's troubling because Silicon Valley has traditionally been a place where new firms can come out of nowhere to topple entrenched incumbents. Yet new firms wanting to compete against Microsoft, Apple, or IBM are increasingly forced to first license the incumbents' patents. It’s hard to win in the marketplace when you're forced to share your revenues with your competitors.

The patent system is a poor fit for the software industry. We shouldn't force the small, nimble firms (which make the field so dynamic) to divert scarce capital to defending themselves against patent lawsuits or amassing patent portfolios of their own. And computer software is already eligible for copyright protection, so patent protection is superfluous for rewarding software innovation.

Zach Carter shows that patent reform is needed, but that it is unlikely.

Today, the patent bill looks like a scorecard tallying points for powerful corporations: a win for pharmaceutical companies whose monopolies are driving up Medicare costs; a win for Wall Street's battle against check-processing patents; a loss for tech giants who had hoped to curb costly lawsuits.

Left out of the tally is the public, even as the economic landscape for American families grows darker. Historian Richard Hofstadter famously observed that Congress during the Gilded Age busied itself with dividing the nation's spoils among the rich and powerful. But as the current patent struggle suggests, the spoilsmen are back and Washington is once again an arbiter of who lands the lucre.

"Congress has lost any capacity to piece together these private interests into a public-welfare-promoting change to the patent system," says Christopher Sprigman, an intellectual property expert at the University of Virginia Law School. "It's really not about optimization anymore, it's about which faction is going to win out."

When legislators first introduced a patent bill in 2005, they designed it to lower the costs of lawsuits burdening Internet and software companies. Lured by the big, juicy settlements to be won by suing huge companies for intellectual property theft, an entire industry had emerged around patent chasing alone. These so-called "patent trolls" don't produce any goods. Instead, they secure unclaimed patents for ideas in use and try to cash out in court.

Trolls file hundreds of lawsuits a year over "low quality" patents -- lobbyist legal jargon for the questionable or downright bizarre patents routinely granted by the understaffed Patent and Trademark Office. In recent years, patents have been approved for products including a wheeled flower pot (patent No. 7,908,942), the crustless peanut butter and jelly sandwich (patent No. 6,004,596), a decorative box that can be placed in a casket (No. 7,908,942) and an accounting scheme that helps people dodge taxes by moving stock options around (No. 6,567,790). Once approved by the patent office, it's difficult and costly to overturn the patent in courts, which grant significant deference to the office's decisions.

...

The United States has always granted patents to new gadgets. Someone who builds a better mousetrap can patent it and secure rights to decades of exclusive production. But in the late 1990s, a Federal Circuit ruling, State Street Bank v. Signature Financial Group, permitted the rise of new "business method" patents, rights applying to the way a business operates. This has led to a host of patents being granted on very broad abstractions: A company called Phoenix Licensing is currently seeking millions from banks for allegedly infringing its patent on printing marketing materials on billing statements.

"They're giving out patents as property rights that have fuzzy boundaries," says James Bessen, a lecturer at Boston University's law school and a fellow at Harvard's Berkman Center on Internet and Society. "Particularly for a software patent and a business method patent, it's very unclear what it covers and what it doesn't. We have this terrible situation where there are thousands and thousands of patents filed each year where we don't know what they cover until somebody's been through a lawsuit."

The Section 18 language to swat away pesky business-method patents -- for banks -- was dropped into the Senate version of the bill by prolific Wall Street fundraiser and third-ranking Democratic Sen. Chuck Schumer (N.Y.), who declined to comment.

"This [is] the sort of gift to major corporations that is the hallmark of bad legislation," says Tom Giovanetti, president of the Institute for Policy Innovation, a conservative think tank that works extensively on intellectual property issues. "Any time you're singling out a particular industry, that's a red flag. This is a case of the banks using their raw political clout."

Schumer's move was the latest of several efforts from the too-big-to-fail crowd to overturn two patents on check processing owned by a company called DataTreasury, which has leveraged huge settlements from megabanks, including JPMorgan Chase, and remains embroiled in legal battles with others.

"This is something that's being pushed by big banks so they can basically railroad a couple of guys who they don't want to pay licensing fees on anymore," says an aide to a Senate Democrat who voted against the patent bill.

In 2007, Congress made a more direct attempt to eliminate DataTreasury's patents, but that effort fell short. This year, Wall Street resorted to broader language that could have implications for other patents. The current language on "business method" patents for "financial services" would also help banks fend off lawsuits like the one filed earlier this year by Phoenix Licensing, the owner of the patent for marketing materials on billing statements.

Schumer's provision infuriates software companies, which have spent years advocating a similar program for tech firms to no avail. "There's been a lot of dodgy business method patents, and I think my industry, the tech industry, has much more claim to being victims of ridiculous business method patents than this check clearing patent that caused a lot of anxiety in the financial services sector," one disgruntled tech lobbyist says.

And, of course, DataTreasury hates it.

"This provision isn’t about reforming the patent process or creating jobs," says DataTreasury President and CEO Claudio Ballard. "It’s about Congress doing a big favor to the banking industry at the expense of inventors and small business entrepreneurs."

DataTreasury's twin cash cows are patent No. 6,032,137 and patent No. 5,910,988. They essentially patent the ability to scan a check and transmit it to a database over the Internet or a fax line. Both fit a long-established pattern of questionable patents issued during times of technological upheaval. "Internet plus thing-that-already-exists equals patent," as one tech lobbyist put it.

"They're generally viewed as patent trolls," says Stanford law professor Mark Lemley, a patent law expert, referring to DataTreasury, which has no employees and over 1,000 shareholders.

Privitizing Medicare

Moneybox points out that 'privatization' is simply not truly possible for some government functions which cannot be outsourced. You can privatize (outsource) the paper production for paper that the government uses, but outsourcing the military to a private company is a bad idea. The same is true of any for-profit company. If Microsoft completely outsources its coding, it ceases to be a software company. It can outsource bits and pieces of coding, but not the strategic parts. Similarly, when the government is 100% paying for Medicare health insurance, there is no evidence that adding another middleman reduces bureaucracy. Private companies are less cost-effective than Medicare:

Chinese manufacturers outsource the retailing and distribution of their products to a 'middleman' like Walmart because Walmart can get their goods to customers much cheaper than the Chinese could do it. Walmart does not merge with its Chinese suppliers because they would see diseconomies of scale. But there is no evidence that privitizing jails saves money. In the long run it just creates another concentrated interest to lobby for increased jail budgets.

I agree with today's David Brooks column on one important point, namely that the Obama administration's criticisms of the current version of the Romney/Ryan plan for Medicare are overstated. But by the exact same token and for similar reasons, I think Brooks' criticisms of the Obama plan for Medicare are wildly overstated. The thesis of the column—which is shared by Romney and Obama—is that it's very important to reduce the growth rate of aggregate Medicare spending.

Brooks says Obama's plan to do this with price controls is doomed for political economy reasons. A politically powerful coalition of elderly people and health care providers will block it. That's certainly plausible. But what's the alternative?

Brooks says the alternative is to insert an additional layer of rent-seekers into the dynamic by contracting Medicare services out to private health insurance companies. There are certainly situations in which it makes sense for the government to contract things out. It would be absurd for the GSA to be manufacturing paper for use in government offices, and doubly absurd for the GSA to be operating tree-cutting operations to procure the wood for use in paper manufacturing. Across government functions there always comes a point where you end up saying "it makes more sense to buy this service from the private sector than to do it ourselves" and people disagree about where that point is. But I don't think there's any other context in which Brooks would say that this form of contracting-out alters the political economy of the situation in the way he seems to think it does here.

Right now both the elderly and health care providers lobby for higher Medicare spending. Creating a new set of Medicare sub-contractors whose industry-wide revenue level is determined solely by their success in lobbying Congress to increase Medicare spending is not going to fix this problem. And I dare say it's obviously not going to fix this problem.

If you read the column, I think that what you'll find is that basically all the analytical work is being done by a project of ideological labeling. Brooks describes this as a plan that works "through a market system" featuring "normal market incentives." He twice calls it a "market-based approach" and once refers to critics as scoffing at "market-based strategies." The idea of a market has positive emotional resonance with many people, so if you convince them that you have a "market-based" alternative to price controls that will sound good. But a system of government-funded subcontractors is only market-based if you squint at it really funny. Or, rather, it's very much a market but it's a market for political influence. Medicare subcontractors will have access to detailed demographic and health status information about their clients which they'll be able to use to create customized mailers in favor of their preferred political agenda which, naturally, will be one of higher levels of government spending and lower levels of government accountability.

Last but by no means least it's simply not the case that contracting out lets you do away with the unelected panel of experts that Obama needs to make his price controls work. The premium support model of Medicare has at its heart a panel of experts determining the value of each person's voucher since absent demographic and health status adjustment the whole system will be ruined by adverse selection.

Friday, September 21, 2012

Debt Burden & Principal vs. Interest

Who has a bigger debt? Both Expect to pay off their debt in 30 years at the monthly payment rate.

Here is another example. The numbers are rough ballpark estimates, but I think they show the issue pretty well:

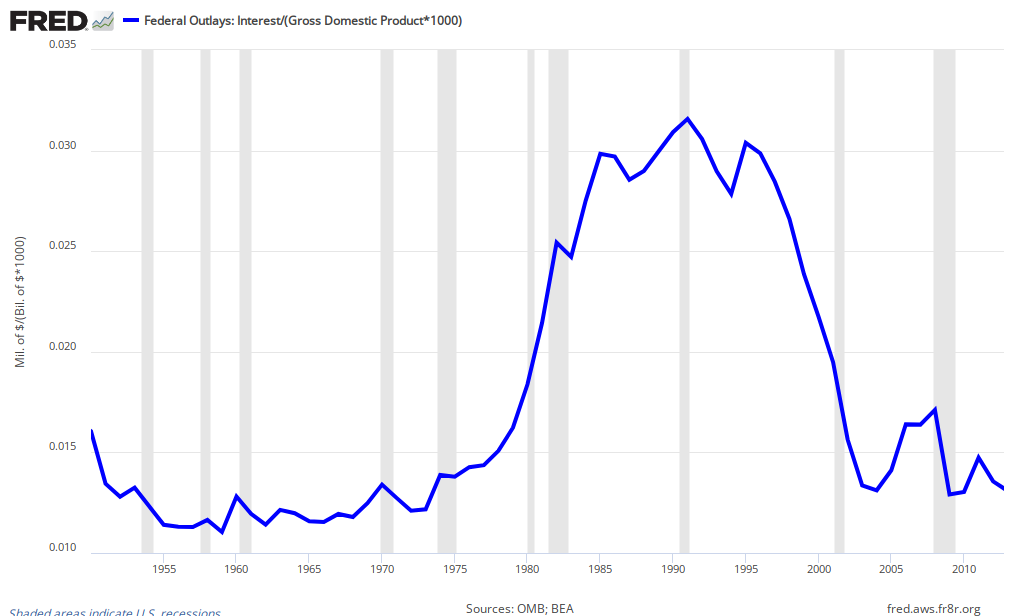

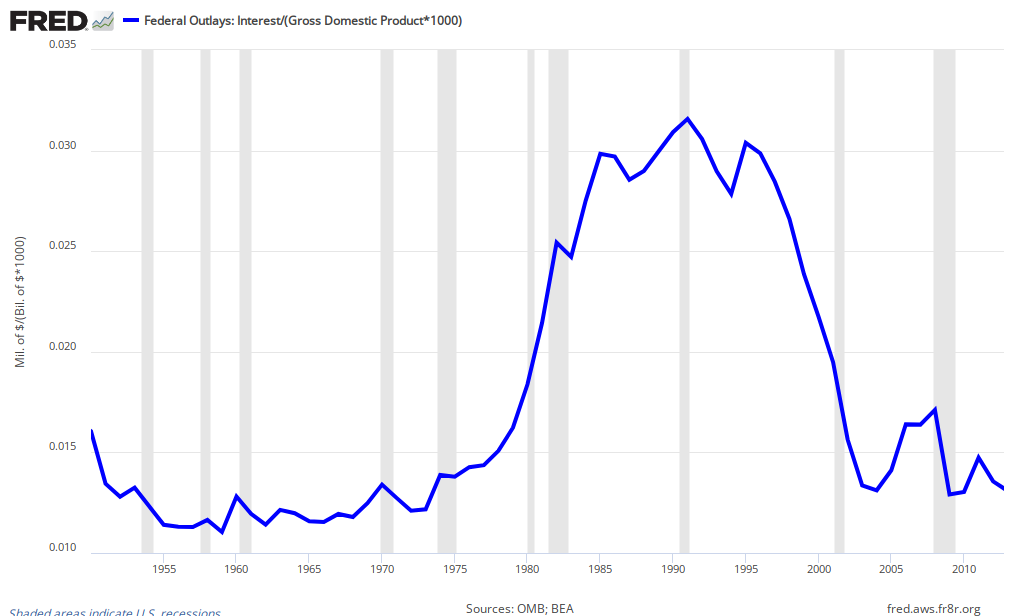

This time I am only looking at interest payments rather than amortizing the principle, but the same principle applies as in the first table. It isn't clear if the real debt burden is higher in 2012 under Obama or in 1988 under Reagan. Of course, these are not real interest rates and so the real expected future interest burden was much less in the high-inflation Reagan years, but the current burden of the debt is the current amount of income that must be sacrificed to pay for debt service which is shown in the graph below.

Dean Baker says that government interest payments are a better measure of our government debt burden than the actual amount of debt. Note that although the interest burden is expected to rise rapidly, in 2012 we are still well below where Reagan and Bush ever got and that did not pose a big problem for the economy.

And what would happen if interest rates rise? Baker has a good answer for that too:

Total Debt

Outstanding

|

Interest Rate

|

Monthly Payments

|

|

John

|

$100k

|

3%

|

$422

|

Sally

|

$50k

|

10%

|

$439

|

Here is another example. The numbers are rough ballpark estimates, but I think they show the issue pretty well:

Total Debt

Outstanding |

Interest Rate

(% of GDP) |

Annual Interest Payments

(% of GDP) |

|

Obama

(end of first term) |

100% of GDP

|

< 3%

|

> 3%

|

Reagan

(end of second term) |

50% of GDP

|

< 10%

|

< 2%

|

This time I am only looking at interest payments rather than amortizing the principle, but the same principle applies as in the first table. It isn't clear if the real debt burden is higher in 2012 under Obama or in 1988 under Reagan. Of course, these are not real interest rates and so the real expected future interest burden was much less in the high-inflation Reagan years, but the current burden of the debt is the current amount of income that must be sacrificed to pay for debt service which is shown in the graph below.

Dean Baker says that government interest payments are a better measure of our government debt burden than the actual amount of debt. Note that although the interest burden is expected to rise rapidly, in 2012 we are still well below where Reagan and Bush ever got and that did not pose a big problem for the economy.

And what would happen if interest rates rise? Baker has a good answer for that too:

Am I pulling a fast one here by switching from debt to interest payments? Not at all. Suppose we issue $4 trillion in 30-year bonds in 2012 at 2.75 percent interest (roughly the going yield). Suppose the economy recovers, as CBO predicts, and the interest rate is up around 6.0 percent in 4-5 years. The federal government would be able to buy back the $4 trillion in bonds it had issued for roughly $2 trillion, immediately eliminating $2 trillion of its debt. This will make those who fixate on the debt hysterically happy, but will not affect the government's finances in the least. It will still face the same interest obligation.I am not as sanguine as Baker about rising interest rates, but he is certainly correct that they have no impact in the short run, ceteris paribus. And one of the things that would raise interest rates is a growing economy which would help us pay off the debt too.

Tax Incidence Questions

- Why did Amazon get very upset that they will have to charge customers sales tax in California even though only Amazon's customers pay sales taxes?

- Should you care if your employer pays half of your payroll tax or if you pay all of it?

- Renters tend to be relatively poor on average and landlords are richer than average. Are real estate taxes progressive because relatively rich landlords (and homeowners) pay them rather than relatively poor renters?

- Are property taxes on the value of land or on the value of buildings going to have a different impact on people?

Tuesday, September 18, 2012

Who Pays Taxes?

Hamilton Project:

Tax Policy Center:

But Nearly Two-Thirds of Households

More than half are elderly

More than half are elderly

Over one-third are nonelderly with income under $20,000

Over one-third are nonelderly with income under $20,000

Only about 1 in 20 is nonelderly with income over $20,000

Only about 1 in 20 is nonelderly with income over $20,000

Who Pays Taxes?

A popular myth swirling around Washington, DC, and throughout the media these days is that many Americans do not pay taxes, and are therefore free-riding off of our society without contributing themselves. This has even been referred to by some as a “new orthodoxy.” The origin of this misconception is the observation that only about 54 percent of American households paid federal income taxes during recession-affected 2011. But that statistic is misleading because it provides an incomplete picture of the overall tax burden on American families, and because it incorporates individuals who naturally shouldn’t be paying taxes because of their age or economic circumstances due to the Recession. A closer look reveals that nearly all Americans do, in fact, pay taxes.

To help illustrate this point, let’s start with some basic fiscal background. Over the last two decades, tax credits for low-income working families with children, like the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC), have indeed decreased the number of American households paying federal income taxes. These credits reduce or eliminate income tax liabilities and sometimes result in a net income tax refund for low-income families.

But these credits are also an important component of the progressive tax system that help offset the burden of other taxes and raise poor working families out of poverty. Credits like the EITC and CTC have helped to reduce poverty, provide economic security, and offset declining labor-market opportunities for low-income workers. The EITC alone is responsible for raising 6.6 million children out of poverty. Perhaps most importantly, these credits expand the number of people contributing to the economy by causing many additional Americans to participate in the labor force and causing others to work more hours.

While this helps explain the declining number of low income families paying federal income tax, it does not address one key point: federal income taxes are only one component of the broader federal, state, and local tax system, and only one way in which Americans are able to contribute their fair share through taxes. Indeed, while some families do not pay federal income taxes, these households do pay other forms of taxes. Those who focus exclusively on the federal income tax ignore one of the most significant federal tax burdens on workers—the payroll tax. In fact, most Americans pay more in payroll taxes than in income taxes.

As shown in the figure below, after incorporating payroll taxes, the proportion of American households who paid federal taxes in 2007, a non-recession year, jumps to 78 percent.

But, when we take the data a step further, even this statistic is misleading because it counts older households, who are often retirees, and young individuals, even if they are still in school. In fact, many households with no tax liability are young or old, meaning that they are likely to be led by students who subsequently will pay taxes or retirees who paid taxes over their lifetimes. The figure below illustrates the relationship between age and the odds of paying payroll and income taxes. The graph makes clear that younger individuals—those in their late teens and early 20s—pay taxes at relatively low rates, but that is largely because they are in school and not working. But as they get older and find jobs, the evidence suggests that they will pay taxes. Similarly, after age 60, when more and more Americans are retiring and leaving the labor force, the fraction paying taxes falls rapidly. These retirees have certainly contributed to America’s revenue stream over their lifetimes. To this point, as the U.S. population ages into the future and a greater proportion of Americans reach the retirement age, it is inevitable that a growing percentage of the overall population will pay no income or payroll taxes.

But during middle age, almost all workers face a tax burden. When looking at those in middle-age, 84 percent faced a net payroll and income tax bill in 2007. This general theme also holds true for low-income households: even households that receive the child-related EITC generally only receive it temporarily, usually when their children are young. On net, even these families face a positive tax bill over time (Dowd and Horowitz 2008).

Furthermore, rising unemployment during the Great Recession has meant that the proportion of American families paying no federal taxes is unusually large today. Unemployed workers without incomes naturally don’t face tax liabilities. But as they find jobs and rejoin the labor force, they will once again contribute to the federal system. Indeed, some of the trends we see today are less illustrative of an unfair tax advantage for the poor; rather, the trends indicate the existence of a group of unfortunate families who have found themselves affected by hard times. And young people today have been particularly hard hit: many are unemployed or weathering the storm in graduate schools, meaning that they are, thus, not paying taxes. When looking more specifically at middle-aged workers with jobs, 96 percent paid federal income or payroll taxes.

Other Forms of Taxes Also Count

Finally, incorporating the additional—and significant—other forms of taxation into our calculation leads to the conclusion that nearly 100 percent of Americans pay taxes in some way, shape or form. All consumers bear the burden of state and local property, sales, and income taxes, as well as excise taxes on items like gasoline, alcohol, or cigarettes. These other taxes tend to be regressive, imposing more of a burden on low-income families than on high-income families—the state and local tax burden is over twice as large as the federal tax burden for the bottom fifth of households (Citizens for Tax Justice 2011). When you fill up your car with gasoline, you can’t avoid paying the tax. The pump does not differentiate between the richest Americans and the poorest families.

Tax Policy Center:

46.4% of Households Paid No Federal Income Tax for 2011

But Nearly Two-Thirds of Households

That Paid No Income Tax Paid Payroll Taxes

Who Paid Neither Income Nor Payroll Taxes?

More than half are elderly

More than half are elderly Over one-third are nonelderly with income under $20,000

Over one-third are nonelderly with income under $20,000 Only about 1 in 20 is nonelderly with income over $20,000

Only about 1 in 20 is nonelderly with income over $20,000

There has been a decline in the number of poor families that pay income taxes too. It has been a longstanding bipartisan effort:

Tax cuts for the poor happened under Richard Nixon and under Ronald Reagan. Tax cuts for the poor was something the Clinton administration and the House GOP was able to agree on. Tax cuts for the poor were a small-but-real element of George W. Bush's 2001 tax cut. Democrats like to help poor people and Republicans don't like taxes, so helping the poor with lower taxes is often something they can agree on. It's a real shame that the official data doesn't capture how successful this is, but it's basically common sense. A conservative movement that can't bring itself to want to help poor people with lower taxes is one that really doesn't care about poor people in a profound way.

But don't take my word for it. Here's Ronald Reagan bragging about his plan to increase the number of low-income and disabled people who don't have to pay federal income taxes:

Subscribe to:

Posts (Atom)